A CFO dashboard is a management tool that visualises financial data to help CFOs understand the financial health of the business. Instead of reviewing static reports and spreadsheets, CFOs use dashboards to track performance, identify risks, and support strategic decision-making.

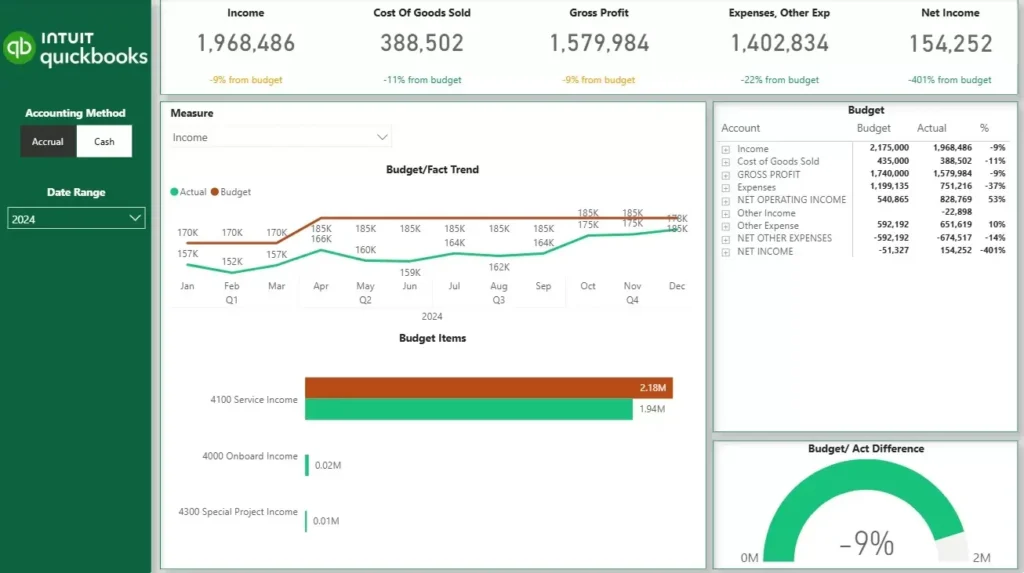

CFO dashboards typically combine data from accounting systems, ERPs, and CRMs into a single view. Depending on the industry, dashboards may include specialised KPIs. However, there are also core financial dashboards that most CFOs rely on, regardless of whether they work in SaaS, professional services, manufacturing, or real estate.

In this article, we will show real CFO dashboards we have developed for clients and explain how finance leaders use them to drive operational and strategic decisions.

Before starting Vidi Corp, I worked as a Financial Analyst at Autodesk, where I built Power BI dashboards for Financial Directors and CFOs. Since founding Vidi Corp, our Power BI consultants have delivered dashboards for more than 100 CFOs and finance leaders, including companies such as Dermalogica and Tikkurila.

Based on this experience, we have seen how powerful CFO dashboards in Power BI can be in transforming the finance function. One example is our work with the CFO of Neterra Telecom. The Power BI dashboards we built delivered tangible business outcomes:

Power BI is particularly effective for CFO dashboards for three reasons. First, it automates data extraction and transformation from multiple financial systems. Second, financial business intelligence and visualisation make it easier to spot trends, risks, and opportunities that are hard to see in spreadsheets. Third, Power BI handles large data volumes without performance issues or file crashes.

All of the CFO dashboards described in the sections below were built using Power BI.

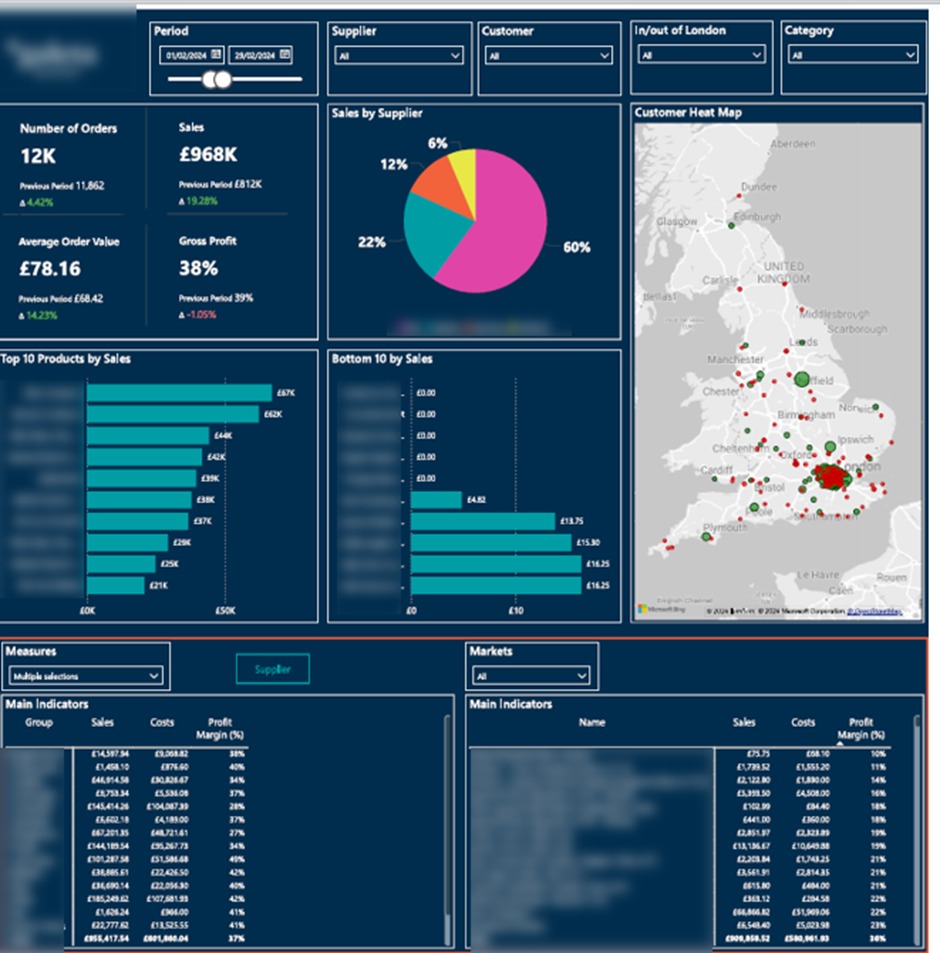

Revenue & Profitability Dashboard gives CFOs a clear view of how sales performance translates into profit across products, suppliers, and regions. By combining order-level data with profitability metrics, the dashboard helps finance leaders understand the factors driving revenue, margin performance, and sustainable growth.

CFO Dashboard Metrics:

The dashboard supports operational decision-making by breaking down sales and profit by supplier, product group, and individual product.

CFOs use supplier-level analysis to manage commercial relationships and identify dependency or margin risks. Top-10 and bottom-10 product views help determine which products should be discontinued, repriced, or promoted more aggressively. Geographic analysis reveals local market penetration and regional growth opportunities.

The flexible filters allow finance teams to tailor views for executive reviews, supplier negotiations, and pricing or product strategy discussions.

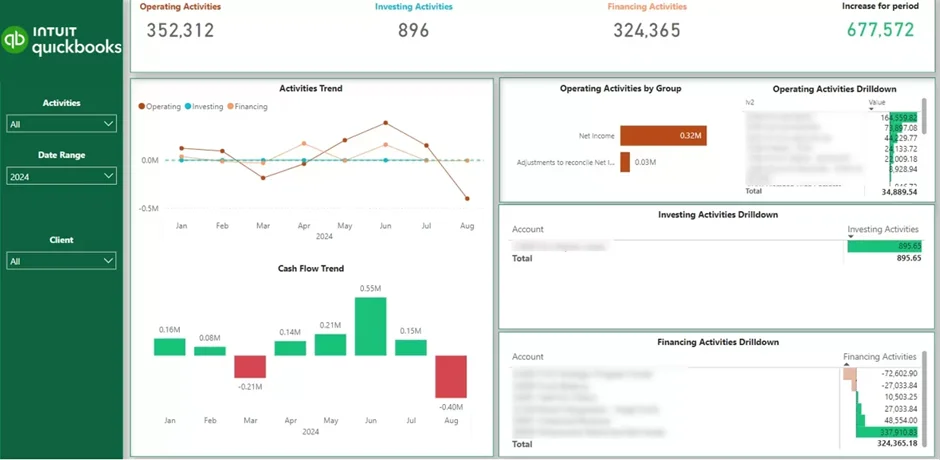

A Cash Flow Dashboard gives CFOs clear visibility into how cash reserves change over time. It shows whether the business is generating cash or consuming it. By tracking month-over-month movements, the dashboard helps finance leaders stay in control of liquidity and financial runway.

CFO Dashboard Metrics:

CFOs use this view to measure burn rate and understand what is driving cash consumption. It becomes clear whether cash burn comes from operations, growth investments, or financing decisions.

These insights support practical decisions. CFOs can adjust spending, slow down hiring, delay investments, or plan fundraising and financing activities before cash pressure builds.

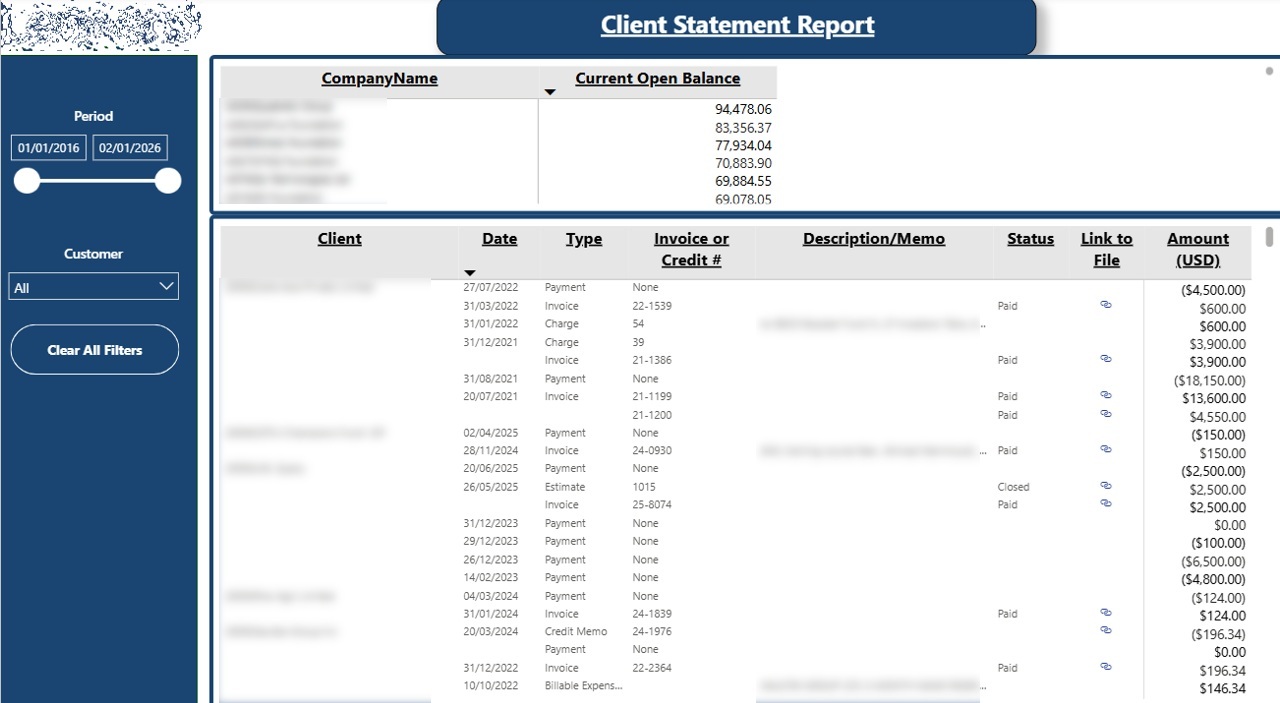

An Accounts Receivable Dashboard gives CFOs full visibility into outstanding customer balances and payment risk. Instead of relying on static aging reports, the dashboard shows who owes money, which invoices are overdue, and how receivables are trending over time. This helps finance leaders protect cash flow and reduce collection delays.

CFO Dashboard Metrics:

The dashboard centralizes all receivables data at the customer level. CFOs can quickly see which accounts require immediate attention and highlight them to the finance team.

By reviewing full trading history alongside open balances, CFOs gain context before taking action. This supports better decisions around credit limits, payment terms, and strategies to collect payments more quickly. The result is faster collections, improved cash predictability, and stronger working capital control.

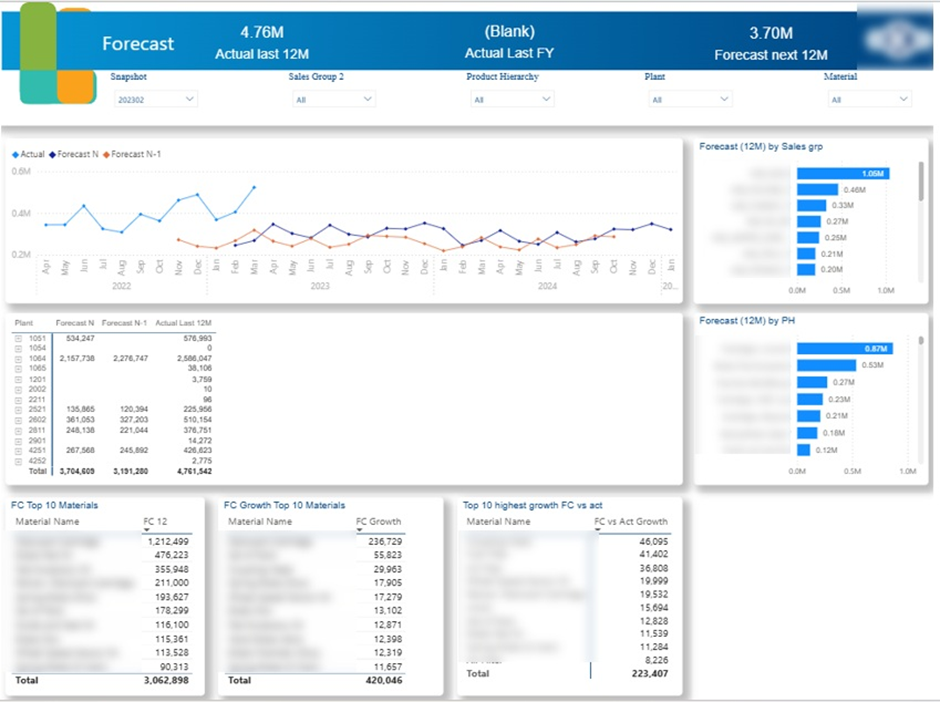

Financial forecasting is a core part of the CFO role. CFOs are expected to predict future revenue, plan cash requirements, and ensure the business is financially prepared for different growth scenarios. A Forecast Accuracy Dashboard helps CFOs understand how reliable their forecasts are and where assumptions consistently over- or under-estimate actual performance.

In my experience at Autodesk, the Power BI financial dashboards I built directly influenced forecasting decisions. Financial Directors reviewed actual performance in Power BI and then entered their forecasts into Anaplan. I later extracted forecast data from Anaplan and joined it with actual sales data in Power BI. This made it easy to compare forecasts against reality and measure forecast accuracy over time. While external tools like Anaplan are common, it is also common to calculate forecasts in Power BI using techniques such as linear regression.

CFO Dashboard Metrics:

When forecasts are reliable and improving, they provide the confidence needed to support expansion, approve additional resources, and commit to long-term operational decisions with lower financial risk. By comparing forecasts with actual results and pipeline assumptions, CFOs can advise whether hiring plans, inventory levels, and investment timelines are sustainable.

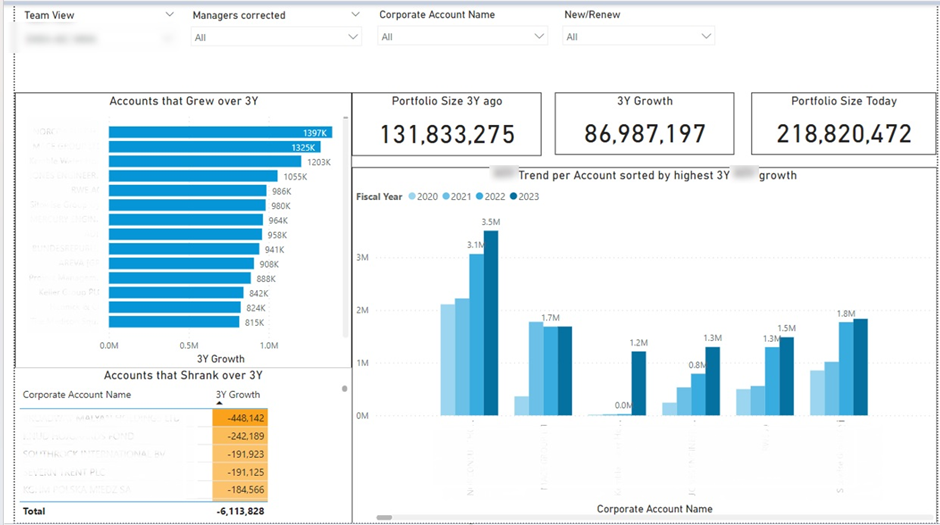

A Client Sales Dashboard helps CFOs understand how revenue from existing clients evolves over time. It provides visibility into which segments of the client portfolio are growing and which are shrinking. This allows CFOs to focus on sustainable growth rather than relying solely on new customer acquisition.

CFO Dashboard Metrics:

CFOs use this dashboard to spot patterns across the client base. It quickly becomes clear which countries and industries deliver the strongest growth and which consistently underperform. This insight helps CFOs guide strategic focus toward higher-growth markets and customer segments.

In one Power BI financial dashboard I created, the analysis showed that the fastest-growing accounts belonged to the same industry. CFOs used this insight to reassess commercial priorities and concentrate resources where portfolio expansion was most likely. In practice, dashboards like this enable CFOs to shape client strategy, reduce revenue risk, and drive growth by acting early on clear portfolio trends.

A SaaS CFO Dashboard gives CFOs visibility into subscription performance, revenue predictability, and in-quarter execution. In subscription businesses, revenue timing, renewals, and deal structure matter as much as total sales. This dashboard helps CFOs monitor how the quarter is shaping up and adjust expectations before results are locked in.

CFO Dashboard Metrics:

Metrics are broken down by subscription type, country, and product group. They are also split between new business and renewals. CFOs frequently compare performance to the same quarter last year and to the previous quarter to add context.

In my experience at Autodesk, Financial Directors used this dashboard throughout the quarter. They adjusted forecasts as new data came in, flagged performance changes to Sales Directors, and monitored linearity to assess execution risk. At quarter end, the same dashboard was used to review results, understand variances, and improve forecasting assumptions for future periods.

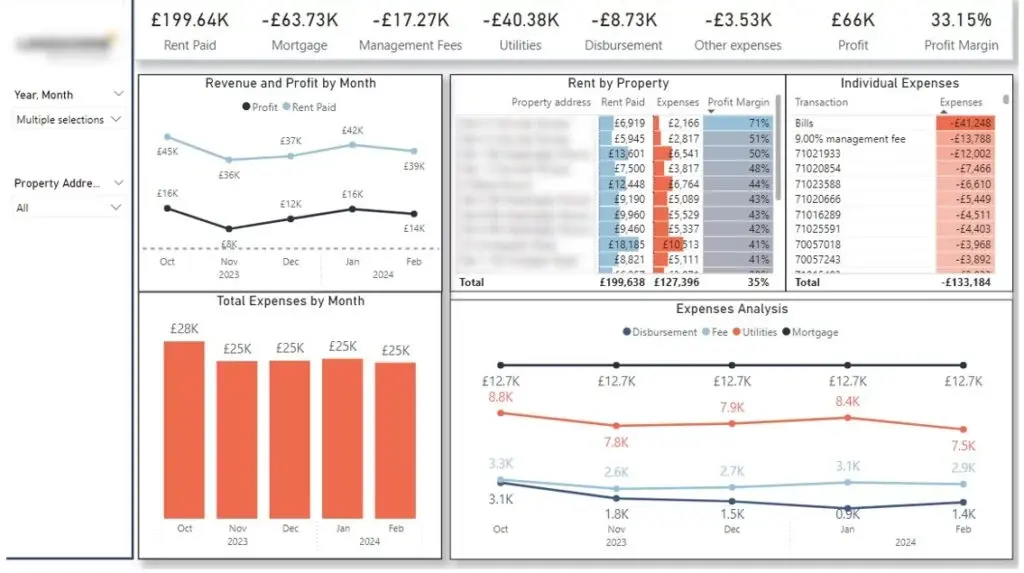

A Real Estate CFO Dashboard helps CFOs monitor financial health, debt exposure, and asset performance across a property portfolio. In real estate businesses, leverage is common, and profitability depends heavily on asset appreciation and rental income. This dashboard gives CFOs the visibility needed to balance growth, risk, and cash flow.

CFO Dashboard Metrics:

The dashboard compares assets against liabilities and breaks liabilities into clear groups. This allows CFOs to evaluate debt exposure and understand how leverage impacts overall financial health.

For rental portfolios, the dashboard provides a clear view of revenue, expenses, and profit by property. In one project, a client with 30 residential properties used this analysis to identify which assets generated the strongest margins. Monthly expense trends helped spot cost spikes early and trace them back to specific expense categories.

Property-level filtering allows CFOs to review rent and expense trends over time. This helps identify vacancies, plan for unexpected costs, and ensure cash flow remains positive across the portfolio.

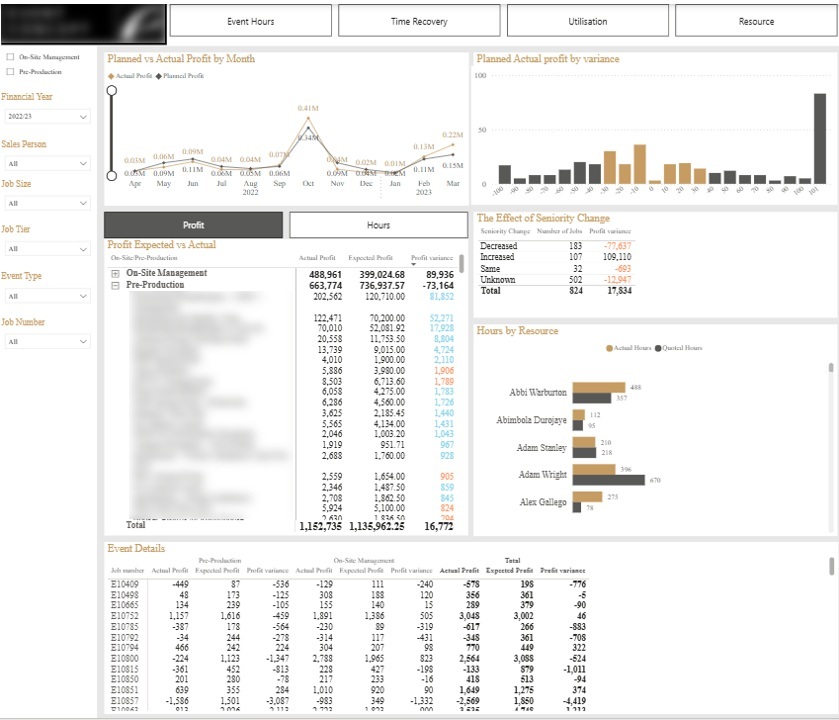

A Professional Services CFO Dashboard helps CFOs understand whether projects are delivering the profit that was originally budgeted. In project-based businesses, small changes in staffing, time spent, or delivery scope can quickly erode margins. This dashboard gives CFOs visibility into where profit leakage occurs and whether the business is improving its ability to meet budgeted targets over time.

CFO Dashboard Metrics:

The histogram at the top groups projects by profit variance brackets, such as +10% or +20% versus budget. This helps CFOs quickly assess how consistently the business delivers against its plans. Tables break down the main drivers of variance, including changes in resource seniority and excess time spent.

Filters allow CFOs to review performance by client and isolate problem accounts. The detailed event-level table at the bottom supports drill-down analysis. Together, these views help CFOs improve pricing assumptions, refine staffing models, and reduce profit leakage across future projects.

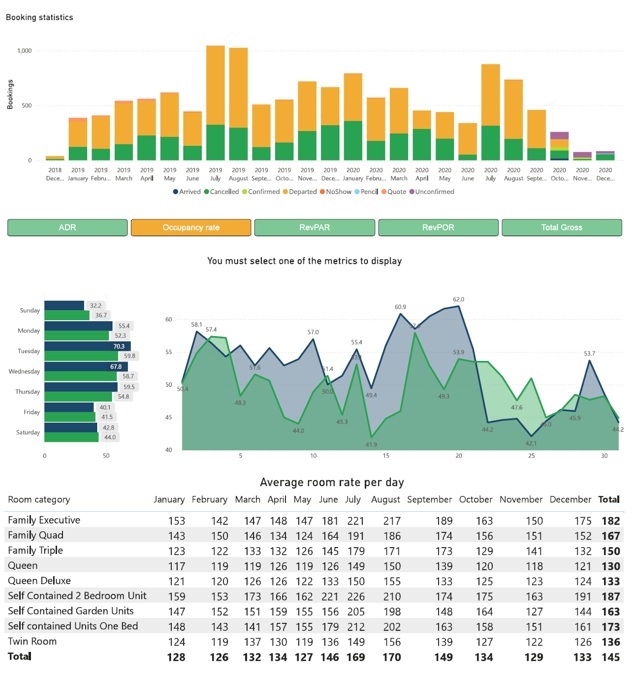

A Hospitality CFO Dashboard gives CFOs a single view of revenue performance and operational efficiency across hotel operations. Instead of reviewing disconnected reports, CFOs can track how rooms, food, drinks, and commissions contribute to overall performance. This dashboard supports faster decisions around pricing, capacity, and revenue optimisation.

CFO Dashboard Metrics:

The dashboard allows CFOs to select a key metric and analyse it across all charts. Metrics can be broken down by day of the week and compared year over year. This makes it easier to spot seasonal patterns and structural changes in demand.

Pricing analysis plays a central role in CFO decision-making. By reviewing average daily room rates by month and room category, CFOs can assess whether pricing strategies are aligned with demand. This insight helps refine rate structures, improve occupancy, and maximise revenue throughout the year.

All the dashboards shown in this article are based on real projects we have delivered for CFOs across industries. If you are considering building or improving your CFO dashboards in Power BI, we would be happy to help.

Contact us to discuss your requirements and see how a custom CFO dashboard can support better financial and operational decision-making in your organisation.