How much time does your accounting team spend on routine, repetitive tasks like entering invoice details, copying numbers between spreadsheets, or matching payments with purchase orders? For many accounting teams, these tasks eat up hours every week, leaving little time for valuable work like analysis, forecasting, or strategic planning.

Now, imagine if all of this could happen automatically without human effort, no delays, no errors, just smooth, hands-free processing around the clock.

That’s exactly where Accounting Robotic Process Automation (RPA) steps in.

As RPA consultants, we have helped dozens of accountancies around the world

Robotic Process Automation (RPA) is a digital transformation process that uses software bots to perform repetitive tasks just like a human would, but faster and without making mistakes.

Unlike physical robots, RPA bots work on computers and interact with digital systems like Excel, ERP tools (such as SAP or Oracle), and accounting software (like QuickBooks or Xero). The best part? They work 24/7 and never get tired.

As accounting becomes more digital, RPA is becoming a powerful tool to help finance teams work faster, reduce errors, and save money.

In this article, we’ll take a quick look at a real-life example of how RPA is used in accounting. We’ll also talk about the Challenges and Benefits that come with using RPA in accounting tasks.

RPA bots work just like a human sitting at a computer:

These bots follow a set of rules. Once trained, they do the same task again and again without making mistakes.

For example, an RPA bot can be used to read data from emails and copy it into an Excel sheet. Another bot might handle tasks like generating invoices or sending payment reminders.

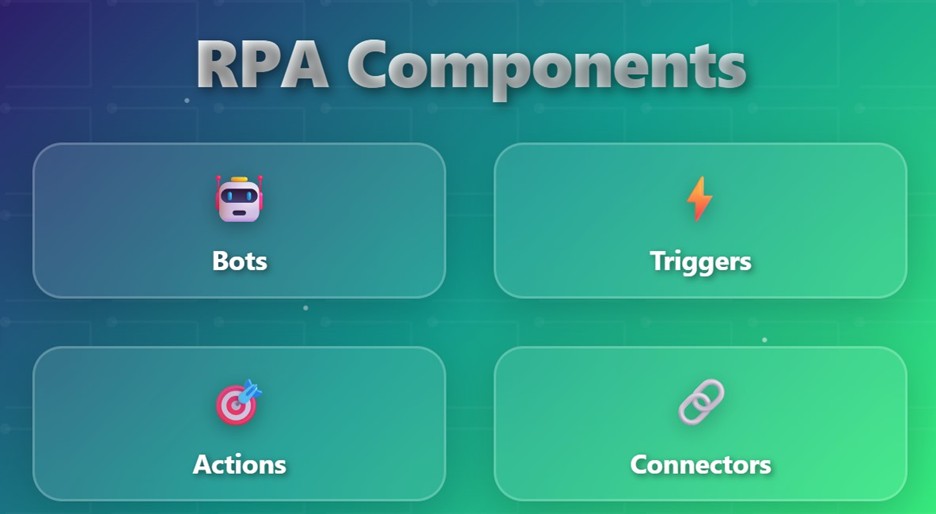

To understand RPA better, let’s break it down into four main parts:

The bots are created using different RPA tools like Power Automate or Zapier. These tools enable you to set up rule-based workflows, which are essentially bots.

Bots can be simple (doing one task) or smart (handling multiple steps and even making basic decisions). These bots consist of a trigger and an action.

A trigger tells the bot when to start. For example:

Triggers automate the start of a task without someone manually launching it.

Actions are the steps the bot performs. This could be:

A single task may include several actions.

Connectors help bots to extract data from different systems or load data in the system. The developers can use the data from the connectors to set up their triggers for launching a workflow. Alternatively, they can use a connector to send the data into a certain system to perform an action, e.g. create an invoice.

Connectors enable the bot to move between tools like Excel, Outlook, SAP, or web portals smoothly, just like a human switching between windows.

Account Receivable bots can automate following up on outstanding invoices, helping to collect the money quicker

We recently automated the process of following up on outstanding invoices for several clients. This included automating the data extraction from QuickBooks Online, automatically checking which invoices are outstanding and automatically sending emails to follow up on outstanding invoices.

Traditionally, teams had to manually download reports from accounting software, organise data in spreadsheets, track invoice status, and send reminder emails, a time-consuming and inefficient process.

To solve this, Vidi Corp deployed a fully automated workflow using a combination of tools and technologies:

1. Vidi QuickBooks Online Connector

This custom connector extracts detailed invoice data directly from QuickBooks Online, including invoice numbers, due dates, client details, and payment statuses and loads it into an Azure SQL Server.

The connector also retrieves invoice PDFs and stores them securely with unique links, allowing for easy referencing in client communications.

Once the data is in Azure, Power Automate takes over. It builds a real-time invoice tracker in SharePoint by syncing and updating data from the SQL database. It then automates customer follow-up emails using pre-filled templates that include dynamic invoice details (e.g., number of days overdue, amount owed).

These flows run on schedules, ensuring timely and consistent communication with clients. Power Automate also controls access to sensitive invoice data using role-based security settings.

3. Power BI

For financial teams, visibility into receivables is critical. Power BI dashboards give live updates on metrics like overdue invoices, average time to payment, outstanding balances by client, and historical trends.

The Power BI dashboard helps to clearly see the outstanding amount of money per client and how long it has been outstanding for.

The CFO of the client company reported the following measurable benefits in his review after this project:

This case study shows how using RPA in accounting, along with tools like Custom Connectors, Azure, Power Automate, and Power BI, can make work faster and more efficient. It’s not just about saving time, but also about helping accounting teams work smarter, follow rules, and make better decisions using real data.

For the full implementation breakdown, visit the original case

Financial Reporting covers automating data extraction, transformation and refresh of the management reports.

Many accounting teams have to prepare month-end reports for their management. These reports take many hours to put together, and the process of creating them is very rule-driven, which indicates a great opportunity for automation.

We recently automated financial reporting for a company called Modern Cannabis. Here are the benefits that their CPO reported in his review:

Here is the step-by-step process for automating financial reports:

Here’s what a typical workflow looks like without automation:

This manual process leads to several challenges:

These issues not only waste time but can also affect cash flow tracking, customer billing accuracy, and audit readiness.

Manual processes like downloading Shopify reports, formatting them, and uploading to accounting software are time-consuming and error-prone. The good news? These challenges can be solved using a set of automation and reporting tools that work together seamlessly. Let’s walk through the solutions below.

One of the biggest bottlenecks in the manual workflow is getting accurate, clean data out of Shopify. VidiCorp Custom Connectors eliminate the need for downloading spreadsheets. They:

This removes the risk of human error in data exports and ensures nothing is missed. It also gives you up-to-date financial data, not last week’s snapshot.

Once the data is extracted, Power Automate steps in to manage the entire process:

It removes the need for repetitive manual uploads and ensures everything runs on schedule. Teams don’t have to remember to do the same task every day; the bot handles it.

After automation is set up, Power BI gives your team a way to actually see what’s happening in real time:

Instead of waiting for someone to finish a spreadsheet, decision makers can log in and see live financial insights at any time.

Key Benefits of RPA in Accounting are as follows:

RPA bots can pull, process, and push data across systems in real time. For example, syncing orders from Shopify to accounting platforms like QuickBooks happens instantly no more delays or waiting for batch uploads.

Manual data entry often leads to typos or mismatches. RPA ensures data is captured and processed correctly every time, greatly improving the accuracy of financial records.

As your business grows, so does the volume of transactions. RPA bots can manage thousands of records without getting overwhelmed, making it easy to scale operations without increasing headcount.

Automation logs and audit trails make it easy to monitor each task completed by the bots. This transparency is especially helpful during audits or when tracking down discrepancies.

In this article, we learned how Robotic Process Automation (RPA) is helping finance teams automate repetitive and manual accounting tasks, such as data entry, invoice tracking, and report generation. By using custom connectors like the Shopify and QuickBooks connectors developed by Vidi Corp, businesses can automatically extract, clean, and sync data into tools like Power BI and Power Automate. This not only saves time and reduces errors but also provides real time financial insights and scalability as your business grows.

If you’re looking to automate your accounting workflows or need a custom connector, Vidi Corp can help design and implement a tailored RPA solution.

RPA stands for Robotic Process Automation. It refers to using software bots to automate repetitive tasks in accounting such as invoice processing, reconciliations, and report generation.

Examples include:

Syncing eCommerce orders with accounting software

Sending automated invoice follow-ups

Reconciling bank statements

Generating daily or monthly financial dashboards

Speed: Real-time updates

Accuracy: Fewer manual mistakes

Scalability: Handles large volumes with ease

Transparency: Provides full audit trails for all actions